|

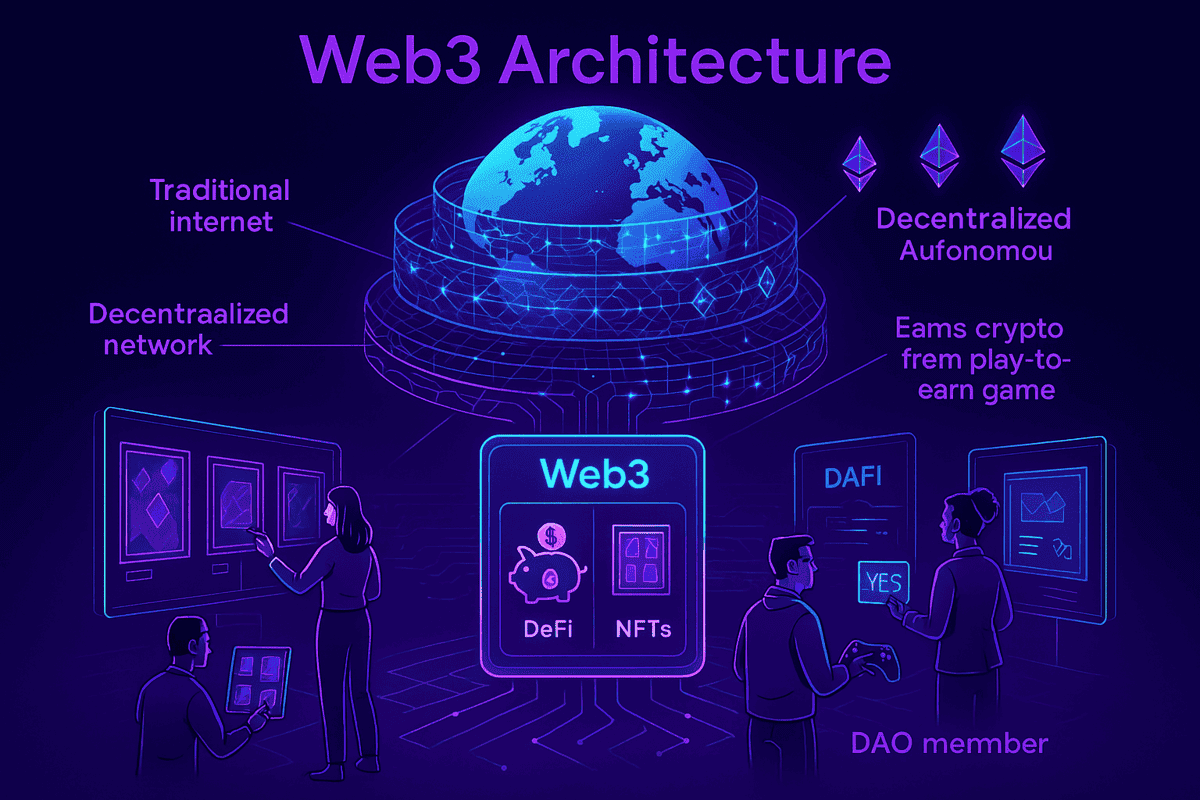

Decentralized Finance (DeFi) has taken the financial world by storm. Over the last few years, it’s gone from a niche concept to a widely recognized movement that challenges traditional banking and finance systems. By using blockchain technology to eliminate intermediaries like banks, DeFi promises greater accessibility, lower costs, and more control for users over their financial transactions.

But as with many emerging technologies, the initial excitement surrounding DeFi has led to a surge in speculation and hype. With decentralized exchanges (DEXs), yield farming, and liquidity pools being the buzzwords of the moment, one has to ask: what comes after the hype? Will DeFi live up to its promises, or is it just another trend that will fade away?

In this post, we’ll explore what DeFi truly offers, the challenges it faces moving forward, and what we can expect as it matures beyond its current hype cycle.

The Rise of DeFi: A Revolution in Finance

DeFi aims to create an open, permissionless, and decentralized financial ecosystem that operates on blockchain technology. Traditional financial systems are heavily reliant on central authorities such as banks, governments, and other financial institutions. DeFi, on the other hand, removes intermediaries, allowing users to lend, borrow, trade, and invest without relying on these middlemen.

This innovation has been particularly attractive to people in regions with limited access to traditional banking, offering an alternative to high fees, slow processing times, and the restrictions imposed by centralized institutions. Through decentralized apps (dApps) built on Ethereum, Binance Smart Chain, and other blockchain networks, users can interact with smart contracts—self-executing contracts with terms directly written into code—making transactions transparent, secure, and tamper-proof.

In addition to providing financial services, DeFi has introduced new ways to earn returns, such as staking, liquidity mining, and yield farming, where users can earn rewards for participating in decentralized networks. The promise of earning passive income while maintaining full control over assets is a major draw for investors and everyday users alike.

The Challenges Facing DeFi

Despite the promise of decentralization, DeFi is not without its challenges. As the industry grows, so do the complexities and risks that come with it.

1. Security Concerns:

DeFi platforms, while offering transparency and security through blockchain, are still vulnerable to hacks, bugs in smart contracts, and vulnerabilities in code. High-profile attacks, such as the 2020 "Compound" hack, have raised serious concerns about the safety of funds held in DeFi protocols. Smart contracts are only as secure as the code written for them, and any flaws or vulnerabilities can be exploited by malicious actors.

2. Regulatory Uncertainty:

As DeFi grows, so does the scrutiny from regulators. Since DeFi eliminates traditional intermediaries, it has left regulators scrambling to figure out how to classify these services. The decentralized nature of these platforms makes it difficult for authorities to enforce traditional regulations. While DeFi enthusiasts argue that the movement supports financial freedom, regulators are concerned about potential risks related to money laundering, fraud, and investor protection.

3. User Experience:

While the promise of decentralized finance is alluring, many DeFi platforms are still clunky and unintuitive, making them challenging for average users to navigate. To interact with DeFi platforms, users often need to understand complex concepts like gas fees, token swaps, and decentralized governance mechanisms. This steep learning curve has limited the mass adoption of DeFi, keeping it largely within the realm of crypto enthusiasts and tech-savvy individuals.

4. Scalability Issues:

DeFi platforms are primarily built on Ethereum, which has faced scalability issues due to high demand on its network. High gas fees and slow transaction times during periods of congestion have been a major barrier to DeFi’s widespread adoption. Solutions like Ethereum 2.0 and Layer 2 scaling solutions aim to address these challenges, but for now, scalability remains a significant issue for DeFi platforms.

What Comes After the Hype?

The initial excitement around DeFi was driven by the potential to disrupt traditional finance. However, now that the hype has settled, the question arises: what’s next for DeFi? Will it continue to grow, or will it fail to live up to its potential?

Here are some key trends to watch for as DeFi matures:

1. Institutional Adoption and Integration:

One of the most significant signs of maturity for DeFi will be its adoption by traditional financial institutions. In recent months, we’ve seen banks and investment firms begin to explore the potential of DeFi, offering blockchain-based services or integrating decentralized protocols into their existing systems. Major companies like JPMorgan and Goldman Sachs have started experimenting with blockchain technology, and it’s only a matter of time before DeFi becomes a mainstream tool for financial institutions.

2. Regulatory Clarity:

As DeFi continues to evolve, regulators will need to create clearer frameworks for how decentralized platforms should be governed. This could provide more stability for users and increase confidence in the space. While this may limit some of the freedom that DeFi offers, it could also pave the way for safer and more mainstream adoption.

3. Improved User Experience:

To succeed in the long term, DeFi must overcome its usability challenges. Platforms that simplify the user experience—while still maintaining the core principles of decentralization—will be essential to attract a wider audience. DeFi projects focused on making onboarding easier, reducing transaction costs, and offering intuitive interfaces will be better positioned for success.

4. Interoperability Between Platforms:

As the DeFi space matures, the need for interoperability between different blockchain networks will become more apparent. Currently, many DeFi platforms operate in isolation, but in the future, cross-chain compatibility will become a major priority. Solutions that allow users to move assets seamlessly between different blockchain networks will help unlock the full potential of DeFi, creating a more unified and efficient financial ecosystem.

Final Thoughts

Decentralized finance has the potential to redefine the future of finance, but it’s important to recognize that we’re still in the early stages of its evolution. The initial hype surrounding DeFi has sparked tremendous innovation, but for it to become a true mainstream solution, it must overcome significant challenges related to security, scalability, regulation, and usability.

As the space matures, we can expect more sustainable growth, with institutional adoption, improved user experiences, and greater regulatory clarity helping to drive DeFi forward. The promise of a decentralized, permissionless financial system is still alive, and with the right innovations and improvements, DeFi could become a core part of the global financial infrastructure.

For now, the key to success in DeFi lies in balancing innovation with responsibility—creating solutions that are secure, accessible, and trustworthy while remaining true to the ideals of decentralization.

Maya Bennett

Blockchain

6k

127

23

Similar News

Podcasts

AI Revolution

AI Barriers

TechTalk AI

AI Conversations

Resources